Shipping Trends for April 2024: Latest Freight Market Cheat Sheet

Download this quick reference guide to stay on top of LTL, truckload, intermodal and cross-border shipping trends, plus tips you can apply to your supply chain.

Welcome to the Freight Market Cheat Sheet.

In this short guide, supply chain professionals (like you) can get a quick update on what's happening in North American freight markets this month.

Get insights driven by market experts and proprietary network data.

(If you'd prefer, you can also download this as a PDF.)

Jump to Section:

Overview | Truckload | LTL | Intermodal

Mexico | Canada | Coyote News

Freight Market Overview

Another month into 2024, and not much has changed — we can essentially say the same things we said in March's Cheat Sheet:

We're two years into the deflationary market, and conditions are still stable — there is plenty of carrier capacity to meet current shipper demand, keeping rates low.

But overall inflation in the economy continues to dissipate, the labor market remains relatively strong, shippers have destocked from 2022 excesses, and consumer spending is stable.

All these should support recovery as we move into the next phase of the truckload market cycle and head towards truckload market inflation later in 2024.

But the market remains stubborn in turning nonetheless.

Though we didn't see much movement in March, and we don't think this month will be too much different, April showers could plant the seeds for May flowers.

Let's look at a few trends before diving into rates and modes.

The Francis Scott Key Bridge collapsed in Baltimore

By far the biggest piece of recent supply chain news, the collapse has, and will continue to create, regional bottlenecks and a shift of ocean traffic flows into other ports.

As tragic and catastrophic as the collapse was, it hasn't created a massive shift in overall freight market trends.

Learn more about what this means for shippers and carriers.

A slight capacity crunch around Easter weekend

The week leading up to the Easter weekend saw things tighten slightly, particularly in seasonal produce markets. This is potentially a sign of that produce season will ramp up (see below).

In the last two weeks of the month, we saw sequential rate increases after a very soft February and March.

Rates actually increased across every region on a week over week (W/W) basis for the first time since Thanksgiving 2023.

Produce season is upon us

We again saw some signs of life from seasonal produce markets later in March, with southern and central Florida, southern Texas and southern California all experiencing rate increases and incremental capacity tightening.

Last year, produce demand was weak, as a number of compounding weather events limited crops yields.

This year, projected yields look better. Furthermore, we’ve seen the total carrier base decline around 5% Y/Y, so we expect to see slightly more capacity disruptions in 2024.

To learn more about these seasonal trends, read the Shipper's Guide to Produce Season.

Here come the new contract rates

With Q1 coming to a close, most shippers with enough volume to conduct a transportation RFP have done so.

In Q2, we start seeing a majority of the awards take effect.

With new contract rates in place, many of them down again Y/Y, it will create further pressure on the carrier base, particularly fleets heavily exposed to the contract market.

Diesel remained flat

National diesel prices had been dropping for four straight months, decreasing -1.2% month-over-month (M/M) in October, -5.6% in November, -6.6% in December and -3.0% in January.

But February reversed course, with fuel trending up 4.1%.

In March, diesel remained essentially flat, with the average U.S. price for a gallon dropping from $4.044 to $4.022.

Softening fuel prices has been allowing carriers to run at lower rates-per-mile, keeping spot rates lower for longer, tamping down the speed to rate inflation.

But if diesel remains elevated (or starts heading back up, as it often does in the summer), carriers can't sustain any more margin compression, and rates will start to rise faster.

Full Truckload Trends: April 2024

After a push upwards in January, February saw rates tip back down across the board.

March started off as more of the same, but ended strong. After several weeks of levelling out, rates ticked back up to close out the quarter.

March ended with rates down -2.5% vs. last month, dry van at -2.4%, refrigerated at -4.2% (with protect-from-freeze demand going down, and the lull before produce kicks off in earnest), and open deck up 1.4% (with construction season getting underway).

We're still below last year's levels, but, once again, we're getting closer to Y/Y rate inflation (now just barely below the tipping point).

Note on the data: all truckload rate figures are derived from Coyote's proprietary transactional data. With thousands of daily shipments, it is one of the largest centralized freight marketplaces in North America.

Want the updated truckload market forecast?

Read the latest Coyote Curve® index, or download the slides for your next presentation.

Note: we'll be publishing the Q2 forecast in mid-April, so stay tuned.

LTL Trends: April 2024

Bid season is underway

After a somewhat slow start to the year, there has been a spike in customer RFQs.

While this is typically a busy time for LTL bids, we've seen a 41% increase in RFQ requests in mid-to-late Q1 compared to late Q4 / early Q1.

We've also gotten roughly 12% more bids this March vs. last year.

Carriers continue to show pricing discipline on all existing business, and many opportunities are coming in with low-to-mid single digit increases. Unlike the truckload market, LTL doesn't tend to have the same ebb and flow — it is more consolidated, and no new carriers are entering the market.

However, LTL carriers are being strategic with new opportunities, bidding much more aggressively on new lanes in markets where they have consistent capacity.

LTL carriers look into dynamic pricing for transactional freight

We continue to hear about LTL carriers either considering or actively developing dynamic pricing models for their transactional business.

Some are doing it already, and are moving towards real-time quotes versus more static monthly or quarterly pricing adjustments.

In these scenarios, a 3PL can help shippers navigate a strategic blend of dynamic and static pricing, potentially leading to reduced costs through smarter routing choices.

Locked in customer specific pricing will remain in-play for consistent opportunities.

Read: CSP vs. Blanket rates: how LTL pricing works

Yellow terminal purchases will come back on-line later this year

We continue to have discussions with LTL carriers that have purchased terminal(s) resulting from Yellow’s bankruptcy.

Most do not have specific dates on when they expect to open, but for many, it looks like the second half of 2024 at the earliest.

It will take time before the market fully regains the lost capacity due to Yellow closing its doors.

This does present a good opportunity for shippers that work with 3PLs, as they collaborate closely with all applicable carriers. To prepare, remember that Carriers opening up new markets (or adding door availability in existing ones), will target fully vetted opportunities with clear commodity, size, lane and volume information.

If you have your house in order, and work with connected providers, you may have opportunities for aggressive pricing benefits.

Related: How to Ship LTL, the Comprehensive Guidebook

Intermodal Trends: April 2024

Volumes are strong, but capacity is stable

North American intermodal volumes are up 8% Y/Y, and 9% looking at just the U.S.; volumes also increased M/M as well.

While domestic intermodal volume saw healthy gains, international volume (originating from overseas import traffic) has seen anywhere from 15-25% Y/Y increases in each month of Q1.

Though this is a bright spot in demand, it is not enough to have an adverse impact on capacity (at least, as of yet).

The railroads added a massive amount of capacity in 2022 and 2023 in response to supply chain disruptions, so intermodal containers and drivers are still available in most major metros on relatively short notice.

Pricing is stable, too

We've seen minimal changes to average all-in intermodal spot rates through March — this current period of spot rate stability continues unabated.

Annual/contract pricing remains stable as well, but downward rate pressure has mostly ended.

That said, any shipper who wants to lock in a fresh 12-month contract rate in the coming weeks...now is a good time.

Contract intermodal pricing is predictable, offering a buffer against volatility, while spot rates will follow the truckload market's lead.

Related: Intermodal vs. Truckload: 4 Things Every Shipper Should Know

Cross-Border Mexico Trends: April 2024

Combined Mexico rates were down again M/M (-1.3% in January, -2.3% in February, -1.8% in March).

In February, we are started to see produce season having an impact, as northbound rates ticked up slightly as outbound Mexico capacity tightened, and southbound rates dropped as carriers attempted to reposition their equipment to take advantage of the supply/demand imbalance.

Yet even with continued produce shipping, end of month/end of quarter (which historically brings higher freight volume), and Holy Week, rates trended down slightly.

While the week after Holy Week / Easter is typically slow, expect mid-April to pickup following peak volumes heading into summer.

Note on the data: all truckload rate figures are derived from Coyote's proprietary transactional data. With thousands of daily shipments, it is one of the largest centralized freight marketplaces in North America.

The Peso is getting stronger

The US Dollar / Mexican Peso exchange rate has dropped over three pesos since the start of 2023, from $1 USD = $20 MXN to $16.50 MXN.

Now, Mexico-based carriers that operate locally in pesos but are paid in USD are experiencing pay deflation. This can result in rate increases where Mexico-based carriers are paid in USD.

A potential carrier strike

Members of the Mexican Alliance of Carrier Organizations (AMOTAC) have advised there might be another carrier strike for the beginning of April following the protests in February.

The protestors goal is bringing awareness to driver safety and crime towards Mexico-based transportation providers.

The February demonstrations did not have a massive impact to rates or capacity.

Next phase of CCP regulation is live

Complemento Carta Porte (CCP) 3.0 went live on April 1st.

This regulation creates additional steps for shippers and transportation providers, and covers both domestic Mexico and cross border shipments.

All carriers, shippers and brokers must be in compliance with the additional regulations of version 3.0 (vs. the previous 2.0 version).

Coyote, of course, is in compliance. Have questions? Check out our FAQ for the Complemento Carta Porte.

Related: How to Ship U.S.-Mexico Cross-Border Freight

Cross-Border Canada Trends: April 2024

Overall Canadian cross-border rates ticked slightly up M/M from February, but were still down -16.5% Y/Y.

Northbound rates (U.S. to Canada) were up M/M by 0.5% and down -19.8% Y/Y. Southbound rates were up 3.2% M/M and down -14.0% Y/Y.

Overall, we’re still seeing available capacity outweigh shipper demand, creating cost stability in the marketplace.

As spring hits Canada and temperatures begin to rise, we’ll see many customers lift their protect-from-freeze requirements, which will open more reefer capacity in the market.

Similar to the U.S. truckload market, the Canadian market is still in a deflationary period, and we don't anticipate any dramatic change to that dynamic for the next few months at least.

Note on the data: all truckload rate figures are derived from Coyote's proprietary transactional data. With thousands of daily shipments, it is one of the largest centralized freight marketplaces in North America.

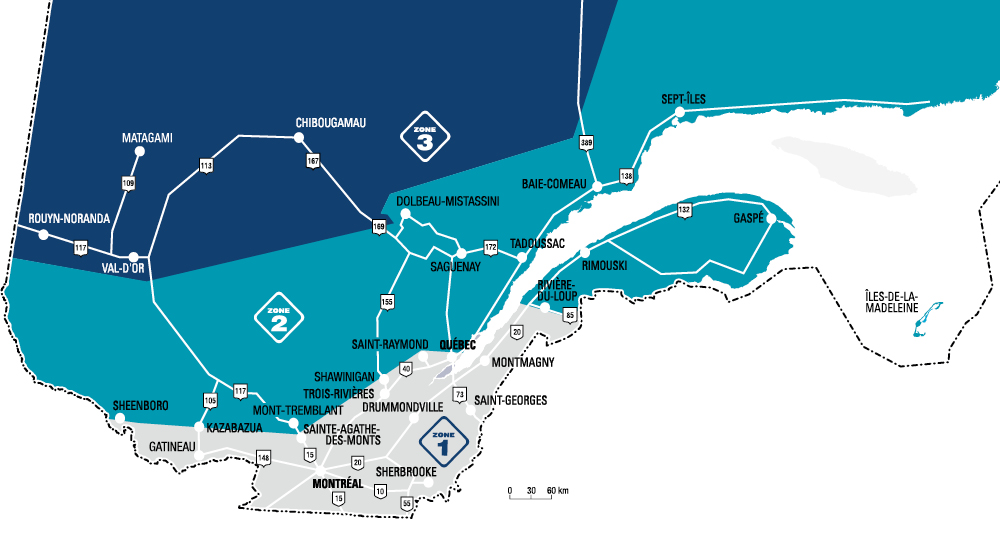

Quebec Thaw Period

Each spring, the Ministère des Transports et de la Mobilité durable determines the thaw period dates for the three Thaw Zones across Québec.

During these times, weight limits for shipment must be reduced to protect the integrity of the highways as they are more fragile than normal during this time period.

- Zone 1: Monday, March 18th (00:01) to Friday, May 10th (23:59)

- Zone 2: Monday, March 25th (00:01) to Friday, May 17th (23:59)

- Zone 3: Monday, April 1st (00:01) to Friday, May 24th (23:59)

For more information, visit the Transport Quebec site.

Image credit: Ministère des Transports et de la Mobilité durable

Related: How to Ship U.S.-Canada Cross-Border Freight

Coyote News

Stay up-to-date with Coyote Logistics.

- Coyote VP of Pricing & Procurement Strategy named a Pro to Know

- Coyote named a top 50 freight provider by ISO